Costs in excess of billings journal entry – Costs in excess of billings, a common concern in the business realm, arise when expenses incurred surpass the amounts invoiced to customers. This discrepancy can significantly impact a company’s financial performance and overall health. Understanding the types, causes, accounting treatment, and financial implications of excess costs is crucial for effective management and decision-making.

This comprehensive guide delves into the complexities of costs in excess of billings, providing insights into their impact on profitability, cash flow, and debt covenants. By exploring real-world examples and practical strategies, we aim to empower businesses with the knowledge and tools necessary to mitigate risks and optimize financial outcomes.

Types of Costs in Excess of Billings: Costs In Excess Of Billings Journal Entry

Costs in excess of billings arise when the costs incurred on a project or contract exceed the amount that has been billed to the customer. These costs can include materials, labor, and overhead.

Materials

- Raw materials used in the production of goods or services

- Purchased components or parts

- Inventory items that have not yet been sold

Labor

- Wages and salaries paid to employees

- Employee benefits such as health insurance and retirement contributions

- Overtime pay

Overhead

- Rent or mortgage payments for the business premises

- Utilities such as electricity and gas

- Insurance premiums

- Depreciation on equipment

Causes of Costs in Excess of Billings

There are a number of common causes of costs exceeding billings, including:

Project Delays

- Unforeseen delays in the project schedule

- Changes to the project scope

- Weather-related delays

Cost Overruns, Costs in excess of billings journal entry

- Underestimating the cost of materials or labor

- Inefficient use of resources

- Poor project management

Billing Errors

- Billing customers for less than the amount that is actually due

- Failing to bill customers for all of the work that has been performed

- Errors in the calculation of the bill

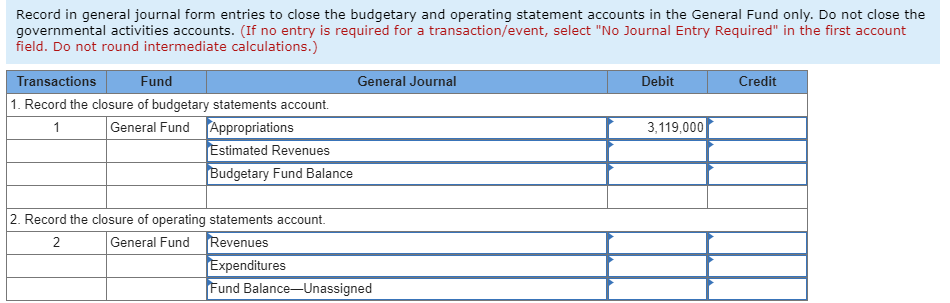

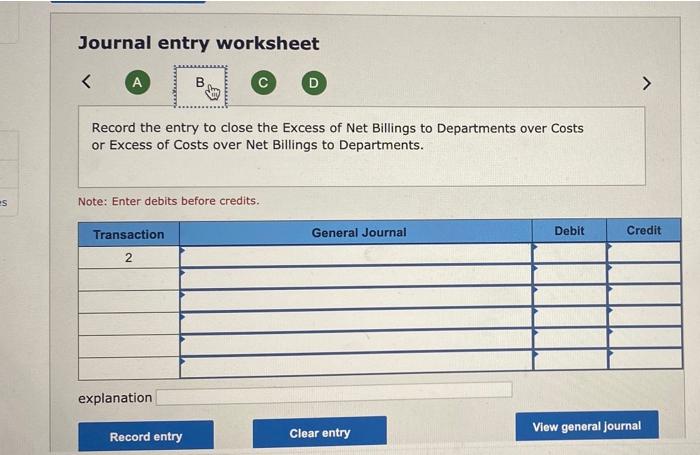

Accounting for Costs in Excess of Billings

The accounting treatment for costs in excess of billings depends on whether the costs are considered to be capitalizable or expensable.

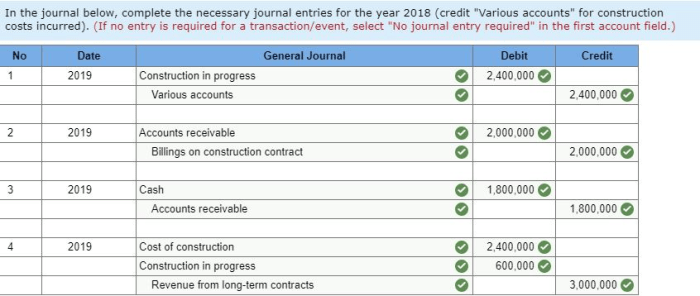

Capitalizable Costs

- Costs that are incurred during the construction or acquisition of a long-term asset

- These costs are added to the cost of the asset and depreciated over the asset’s useful life

Expensed Costs

- Costs that are incurred during the normal course of business operations

- These costs are deducted from revenue in the period in which they are incurred

Journal Entry

The following journal entry is used to record costs in excess of billings:

Debit: Costs in Excess of Billings

Credit: Work in Progress

Financial Implications of Costs in Excess of Billings

Costs in excess of billings can have a significant impact on a company’s financial performance.

Profitability

- Excess costs can reduce a company’s profit margin

- This is because the company is incurring more costs than it is able to bill to its customers

Cash Flow

- Excess costs can also impact a company’s cash flow

- This is because the company is paying for costs that it has not yet been able to bill to its customers

Debt Covenants

- Excess costs can also impact a company’s debt covenants

- This is because excess costs can lead to a decrease in a company’s financial ratios

- This can put a company in breach of its debt covenants

Commonly Asked Questions

What are the most common causes of costs in excess of billings?

Project delays, cost overruns, billing errors, and changes in project scope are among the most frequent causes.

How should costs in excess of billings be accounted for?

Depending on the nature of the expense, excess costs can be capitalized or expensed.

What are the financial implications of costs in excess of billings?

Excess costs can impact profitability, cash flow, debt covenants, and financial ratios.