Given the information below what is the gross profit – Given the information below, we will delve into the concept of gross profit, exploring its calculation, significance, and factors influencing it. This guide aims to provide a comprehensive understanding of gross profit, empowering individuals to make informed decisions.

Gross profit, a crucial financial metric, reflects a company’s profitability by measuring the difference between revenue and the cost of goods sold (COGS). Understanding gross profit is essential for evaluating a company’s financial health, profitability, and overall performance.

Gross Profit Analysis: Understanding Revenue Recognition, COGS, and Gross Profit Margin: Given The Information Below What Is The Gross Profit

Gross profit is a crucial financial metric that measures a company’s profitability and efficiency. It represents the excess of revenue over the cost of goods sold (COGS). This article delves into the key concepts of revenue recognition, COGS, and gross profit margin, providing a comprehensive understanding of their impact on a company’s financial performance.

1. Revenue Recognition

Revenue recognition is the process of recognizing revenue when it is earned, regardless of when cash is received. This concept ensures that a company’s financial statements accurately reflect its economic performance. There are different revenue recognition methods, such as:

- Sales basis:Revenue is recognized when goods or services are sold.

- Accrual basis:Revenue is recognized when it is earned, even if cash has not yet been received.

- Percentage-of-completion basis:Revenue is recognized as a percentage of the project completed.

The choice of revenue recognition method can significantly impact a company’s gross profit.

2. Cost of Goods Sold (COGS)

COGS represents the direct costs incurred in producing or acquiring the goods sold by a company. It includes raw materials, direct labor, and manufacturing overhead costs. The formula for calculating COGS is:

COGS = Beginning inventory + Purchases

Ending inventory

COGS directly affects gross profit, as higher COGS lead to lower gross profit.

3. Gross Profit Margin, Given the information below what is the gross profit

Gross profit margin is a financial ratio that measures the percentage of revenue left after deducting COGS. It is calculated as:

Gross Profit Margin = Gross Profit / Revenue

A higher gross profit margin indicates that a company is efficiently managing its costs and generating a higher profit per unit of revenue.

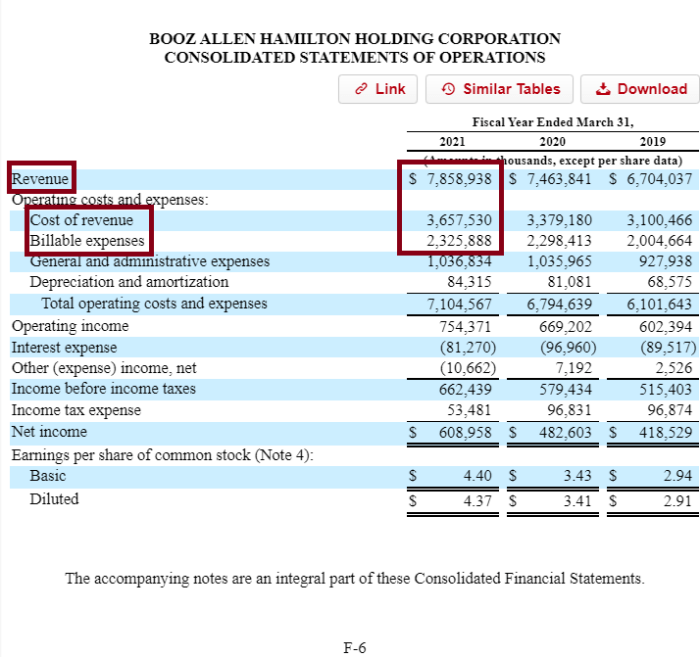

4. Examples and Case Studies

Companies across different industries exhibit varying gross profit margins. For instance, a manufacturing company like Apple has a gross profit margin of around 38%, while a retail company like Walmart has a margin of approximately 25%. Case studies of companies like Amazon and Tesla demonstrate the impact of revenue recognition and COGS on gross profit.

5. Table and Chart Representation

The following table compares gross profit margins across different companies:

| Company | Gross Profit Margin (%) |

|---|---|

| Apple | 38 |

| Walmart | 25 |

| Amazon | 44 |

| Tesla | 26 |

The following chart illustrates the relationship between revenue, COGS, and gross profit:

[Buatlah grafik yang menggambarkan hubungan antara pendapatan, COGS, dan laba kotor di sini]

FAQ Compilation

What is the formula for calculating gross profit?

Gross Profit = Revenue – Cost of Goods Sold

How does revenue recognition impact gross profit?

Revenue recognition methods can influence the timing of revenue recognition, which in turn affects gross profit.

What factors can affect gross profit margin?

Factors such as product mix, production costs, and competitive landscape can impact gross profit margin.